The most challenging part of an M&A is often not the deal but the integrations of the two organisations: What pre-planning and governance can be put in place to ensure the integration team can hit the ground running once the deal is done?

If you were to ask any business that has been through a merger and acquisition process, it’s likely that they’ll have their war stories around the chief challenges of integrating different teams, processes, assets, and strategies. In our ever-changing business landscape, many organisations look to buy into – or take over – complementary businesses to enable them to better scale, develop new markets, deliver new products, or achieve their aggressive growth targets.

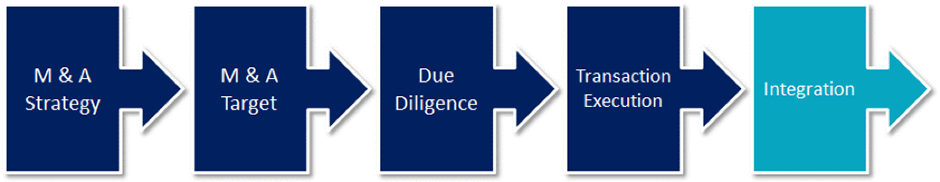

Company acquisitions follow a well-worn path per the below. The first three stages of M&A are typically about the deal led by an advisory team set-up and driven by a deal maker (often external to the business), who will be heavily focused on achieving the fourth step: Executing the transaction.

Often by the time the organisation reaches the fifth stage of integration, the Advisory team has been disbanded and the deal maker has left the building.

What is the effect of simply throwing the merger over the fence – often to a brand-new team with little context – once the deal is done? What steps can be taken to ensure the integration has the best possible chance to be successful and there is some continuity between the critical phases of deal execution and integration?

The Essential Ingredients for Integration

Anyone who has been through an M&A knows that there are deal makers in business who generally have a mastery of numbers, are insightful, passionate and driven to lead and achieve the best sales or purchase outcome for the client. Rarely, however, do these deal makers have (or desire) a seat at the table when the implementation of the deal takes place.

During the final stage of an M&A, the process of integration is typically handed over to an entirely different team in order to achieve the desired business goals from the transaction. The ‘integration team’ now must deliver the benefits to the organisation. It is, in essence, a large program of change projects.

Regardless of the team shape the integration stage of an M&A is almost universally challenging often because expectations of a smooth implementation set by the advisory team during the deal is met with the cold realities of the challenges of project delivery encompassing the whole organisation.

So What does an ‘Integration’ Team Typically Look Like?

Most organisations choose one of three paths to resource their integration team: Bring in the implementation specialists to shape, establish and then deliver the transition; alternatively, they go it alone and use an in-house team or try and achieve a blended team to get the outcome augmenting in house personnel with outside specialists.

Typically one of the senior management team is identified to be the Implementation Sponsor, who will then provide updates to the executive leadership team and/or a board.

This Integration team is for the most part largely independent of the Advisory team and is:

- Staffed by non-executive resources

- Often split between BAU and Integration priorities

- Often developing the processes for the first time

- Need to plan, manage, control all aspects of the integration

- Split focus on existing business and new business integration

Some Sobering Statistics: The Deal Is Only Half the Battle

The integration is often the most difficult part of any merger or acquisition. Things quickly become real with employees’ roles changing or disappearing, new structures, new people and often a difficult blending of cultures to shape the new organisation. Due to the secretive nature of much M&A activity often the integration team comes to the party quite late and any opportunity for pre-planning and getting the governance established can be lost which exacerbates many of the challenges above.

Recent studies support this observation. KPMG, A.T. Kearney, and the Harvard Business Review point to some confronting realities about the M&A process. KPMG found that 83 percent of mergers did not boost shareholder returns while A.T. Kearney concluded separately that the total returns on the lion’s share of M&A were actually negative. The HBR found that the failure rate of M&As often sits between 70-90 percent.

So why do such failures occur? When we delve into the ‘why’ of a failed M&A, the answers typically point to poorly executed integration, such as:

- Actual value of the M&A not matching the theory

- Lack of clarity and planning of the integration process

- Culture integration proving difficult

- Capacity BAU v integration, “conflicting priority”, “bandwidth”

- Higher integration cost than expected

- External business environment changes e.g. Regulatory

When the advisory team hand-off to the implementation team there are often poor lines of communication, no direct link back to the ‘’why’’ of the deal, a lack of context, no adequate pre-planning or governance structure. Nor is there any tangible accountability on the Advisory team to ensure the integration is successful. The Implementation Sponsor is often thrown a grenade to catch and just needs to deal with it as best that they can!

Smoothing ‘’The Hand-Off’’ from Deal to Integration

First and foremost, the steps to avoiding – or stemming – the bleeding is that it is critical to get the communication, planning and governance right in setting up and ensuring a successful integration – regardless of how it came about.

Rather than just engaging the integration team at the back end of the process a more prudent M&A implementation approach is to ensure there remains a linkage between the deal and the integration.; even to the point of the integration lead or sponsor being part of the deal team, at least toward the later stages of the transaction. In addition to ongoing dialogue, some basic project planning should be done in parallel with the initial stages of a potential deal to enable the business to start preparing for integration.

Part of the pre-planning should, crucially, include what the governance needs to look like – not just the critical terms of reference but also personnel – for the project to be successful. This exercise could include establishing a Steering Committee, or at least a sub set of one with an integration project manager, to shadow the deal to begin to prepare for the complexity of the integration to come.

At the End of the Day, Integration is Hard

Integration of two entities will always be difficult. But there are some steps that can be taken during the M&A cycle to limit the chaos that a poorly planned or executed integration project will cause.

Wherever possible, ensuring there is ongoing communication between the deal team and the integration team is vital. With some early pre-planning during the early stages of the deal (including the creation and acceptance of the right governance, with roles and responsibilities and targeted terms of reference), there is every opportunity to set the integration up for success.

Bringing the integration team on-board early is vital to ensure that they can address challenges quickly and make the deal come to life. While it may seem like Project Management 101, the reality is that with the high level of failures in the M&A process, early engagement of project fundamentals are critical parts of a successful M&A journey.

We believe that quality thought leadership is worth sharing and encourage you to share with your colleagues. If you’re interested in republishing our content, here’s what’s okay and what’s not okay.

To speak to our team about how we can help your business deliver better projects, please contact us.