Changes to Australian payroll reporting require businesses to update their payroll systems to accommodate the Single Touch Payroll. But should this be a WFM project or not?

Recent legislative changes mean that implementing Single Touch Payroll (STP) is now a requirement for Australian businesses with 20 or more employees. Along with other Federal Government initiatives such as MyGov and SuperStream, Single Touch Payroll is a leap forward in the Government’s ‘digital by default’ agenda and represents a significant impact for employers and employees.

As specialists in Workforce Management and Human Capital Management, we are driven to ensure that our clients are set up for success. Given that payroll touches everyone in the organisation, how can you ensure that your business is ready to roll out changes required as part of STP?

What is STP and what does it mean for your business?

Included as part of the Government’s Budget Savings (Omnibus) Bill 2016, Single Touch Payroll is a legislative requirement that aims to deliver transparency in payroll reporting and level the playing field to ensure that all employers are meeting their taxpayer obligations.

Envisaged advantages include:

- Auto reporting

- Activity statement compliance efficiencies

- Validated new hire data

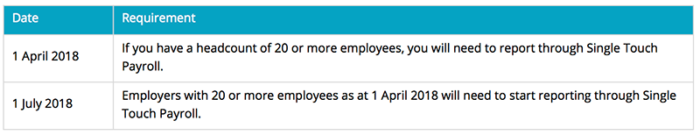

If you have 20 or more employees on 1 April 2018 and you are using a payroll solution, it will need to be updated for Single Touch Payroll reporting from 1 July 2018. Reporting through STP means that as the normal payroll process is completed, there are several automated processes that will occur:

- Employee PAYG tax withholding and super guarantee information will be sent directly to the ATO via your payroll solution;

- When you pay employee super guarantee contributions to the super fund(s), the same information will be sent to the ATO;

- You won’t be required to provide employees with a payment summary covering the same information at the end of the financial year;

- You will have the option to invite your employees to complete their tax file number (TFN) declaration and superannuation standard choice forms online.

You will need to finalise Single Touch Payroll reporting and notify the ATO by 14 July each financial year and the ATO will make information available to employees and their tax agents through ATO online. The ATO will also pre-fill each employee’s tax return. The ATO will provide assistance to employees who have difficulty accessing information online.

The table below shows the key dates and requirements for Australian businesses:

The ATO are working with payroll solution providers to ensure their products are ready for Single Touch Payroll reporting, however to ensure your business is ready in time, there needs to be recognition in your organisation that this is a change that is not negotiable. It impacts everyone.

Get set up for success, starting now

In our WFM work, we are often brought into a project when it has started to go off the rails or failure is looming. It doesn’t have to be that way.

The Single Touch Payroll requirements impact the whole organisation, therefore it’s vital to drive both the change and communication about the change across the business to ensure your employees understand the “what, why, and how” of payroll that is impacted by STP.

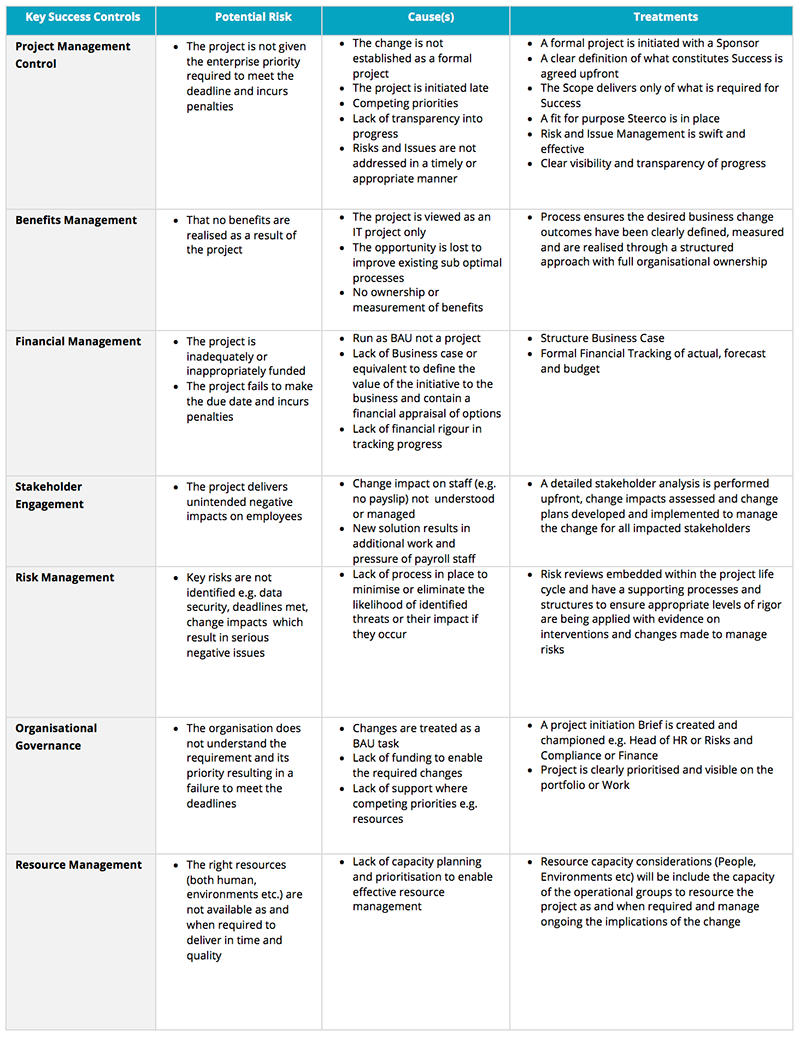

To maximise the opportunity for successful delivery, we believe it should be run as a project. Our view is that a robust P3M3 aligned framework is valuable whenever there are changes that impact the whole business. All too often, we see organisations undertake significant change without adequate success controls in place or processes to identify, mitigate, and treat risk.

When organisations set up for success and plan ahead for recovery if things go wrong, there is a greater chance of righting the project before it breaks its axels. Using the Single Touch Payroll requirements as an example, we’ve outlined seven key success controls that – if planned for – can make the difference between successful rollout or potential failure.

Unsure if you’re set up for success? Run diagnostics

As we mentioned above, Quay is committed to helping clients to deliver successful change and to build capability within project teams.

Based on feedback from our clients, we know that being able to identify the point at which a project is starting to fail isn’t easy. However if you’re unsure about whether the project is on-track, then one of the first steps to take is running a diagnostic.

To that end, we’ve developed an online diagnostic tool that may help. Quay Diagnostic helps project managers and project sponsors to run a quick, objective assessment of how well they are set up for success. To find out more, contact our team or visit www.quaydiagnostic.com to try it out.

We believe that quality thought leadership is worth investing in. Please share our content with your colleagues via any of the links below.

Want to talk to us about WFM or running diagnostics across your projects? Contact us here or call 02 9098 6300.